Key highlights:

- Chainlink was unlocked $ 14.875 million ($ 216 million) and stored in Binance.

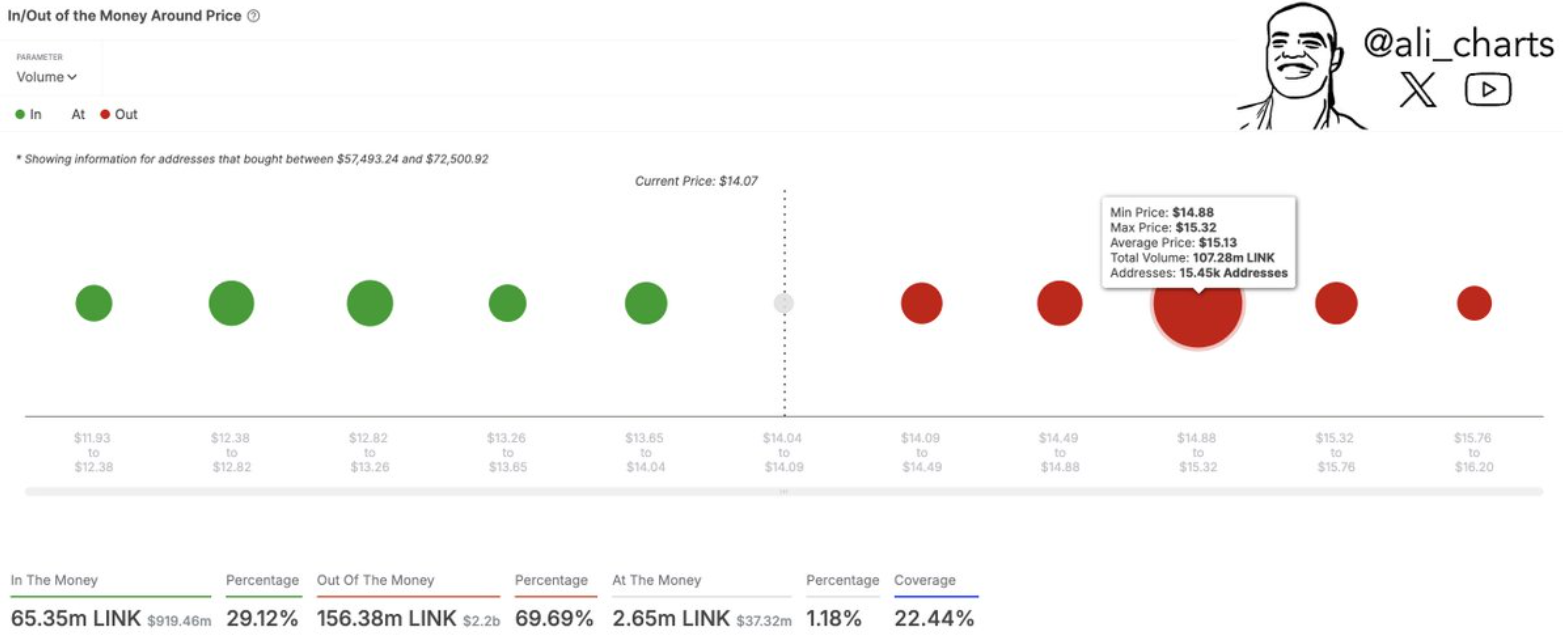

- Link sees a strong resistance at 15 US

- 640,000 connections were withdrawn from the exchange and the accumulation of the signal accumulation

Lookonchain reported that Chainlink (link) relaxed 14.875 million Link token worth $ 216 million from his non-circulating wallet. These tokens were then deposited on Binance. The story shows that nine former unlocks have led to a link price growth within 30 days.

In addition, long-term owners have proven their accumulation strategy by withdrawing 640,000 link from Exchange platforms. At the time of the press, the price level of $ 15 is a decisive point. It holds over 107 million connections in the hands of 15,500 investors.

$ 216m unlock hits binance: could the story for Chainlink repeat yourself?

Large token prolongs often produce market uncertainties because they may lead to the sale of pressure. This increases the offer and leads to temporary drops of price.

Historically speaking, the chainlink prices tend to rise after large token relaxation. This latest event could lead to a similar price movement.

Investors assume that the same upward connection price will continue, since nine out of ten previous unlocks led to price increases. However, the market reaction to additional token distribution determines the performance of the price.

Chainlink will drive his upward trend if market demand remains high. However, the token can temporarily fluctuate if the sales pressure exceeds the purchase interest.

Link is facing a decisive test for 15 US dollars – Breakout or rejection?

In the meantime, the resistance of $ 15 for the link price remains strong. According to Intotheblocks in/out money, 15,500 investors still have 107 million link token.

The token requires a successful breakthrough in this specific zone to advance. And a successful section of 15 US dollars will create conditions for an upward movement of $ 18 to 20 US dollars.

On the other hand, Chainlink will probably experience a short -term price correction regarding $ 13.50. The token could possibly also achieve $ 12.80 if the resistance at 15 US dollars has not been successfully broken. However, technical indicators remain encouraging.

According to analyst Daniel Ramsey, cryptocurrency was reinforced when it recovered from a critical support zone. This included the 200-dayemaema and an ascending trend line.

Therefore, the current market campaign pointed out that investors enter the key price and thus strengthen the bullish conditions.

Exchange drains and bullish mood contribute to the optimism

The positive outlook is supported by the movement of 640,000 link tokens in the last 24 hours. This data results from Santiment, which highlight a remarkable trend.

Exchange drainage of considerable tokens -usually the accumulation behavior than the distribution behavior usually indicate. A link price thrust can occur because the demand remains increased.

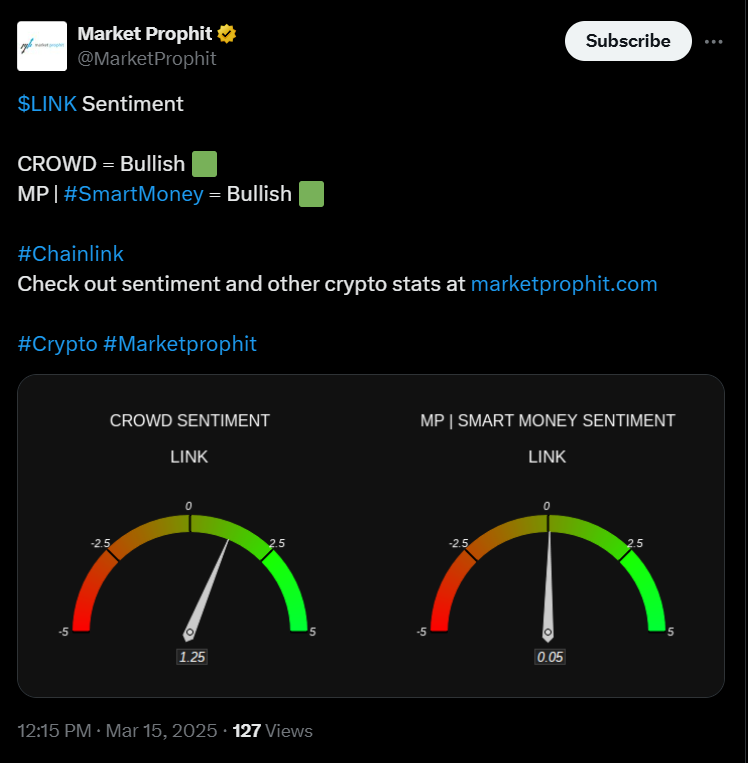

The bullish perspective receives additional support from the analysis of the mood data. The indicators show positive optimism from both retail dealers and Smart Money investors.

Can link break out or is there another retreat?

The combination of technical support resistance and increasing trust of investors refers to a promising view for Chainlink. In addition, a strong accumulation of on chains increases the likelihood of a potential outbreak.

It has the potential to speed up quickly after breaking $ 15, which would drive to $ 18 and additional profits. If the resistance is strong, the link price can experience a short consolidation phase or a slight waste before the upward trend is resumed.

Disclaimer

This article only serves for informative purposes and does not offer any financial, investing or other advice. The author or all the persons mentioned in this article are not responsible for financial losses that can occur through investment in or trading. Please research your research before making financial decisions.